With over 16,500 APIs in existence today, the question is not if APIs are needed but how many are needed. To improve the efficiency of a modern organization, an API integration facilitates the organizations with seamless connectivity between multiple API interfaces. Although, an external API integration software will do its job perfectly fine. What makes the API integration in the FinancialForce ecosystem unique is its capability to allow enterprises to share data and processes across all their applications in ONE PLATFORM. Isn’t that convenient? One holistic platform with everything the enterprise needs.

Benefits of APIs and FinancialForce Integration

Break Product Silos

Customers are the lifeblood of a business. Operating in silos affects the performance of this department as it’s interlinked with other specialized departments.

If we see the example of a bank, banks have a product-focused approach in which they are divided by departments and each deals with a specific banking product. However, with customer accounts fragmented and distributed around different departments, data silos are predictable. Therefore these silos make it difficult to provide a seamless, attentive, and personalized service – sounds familiar? This is when rearranging company data centers and centralizing all the databases turn out to be extremely beneficial in terms of customer service.

What to expect out of a FinancialForce API integration?

Now that we acknowledge the need to break departmental silos, how does an API integration within your FinancialForce aid in the process? These are the following benefits of integrating APIs with your FinancialForce:

- All-in-one-access for customers to avoid switching systems & accomplish their task on time.

- Enhanced productivity by leveraging automation & removing duplicate data.

- Single data source to collect information helps in tracking customers’ engagement.

- Sophisticated analytics using data from all integrated platforms.

- Enable customers to socialize by virtue of networking through Communities, and

- Use collected customer data to provide a personalized customer experience.

The FinancialForce integration landscape is wide, comprising Jira, ServiceMax, Magento, Zoom, Salesforce CRM, DocuSign, and more. For instance, DocuSign increases invoicing speed by 98% resulting in an increase in revenue for the professional services companies. A tool such as Jira is essential for service companies to pool their resources with the right tools to stay aligned with individual tasks and to secure critical data records. Learn more about the benefits of API integrations in this article below.

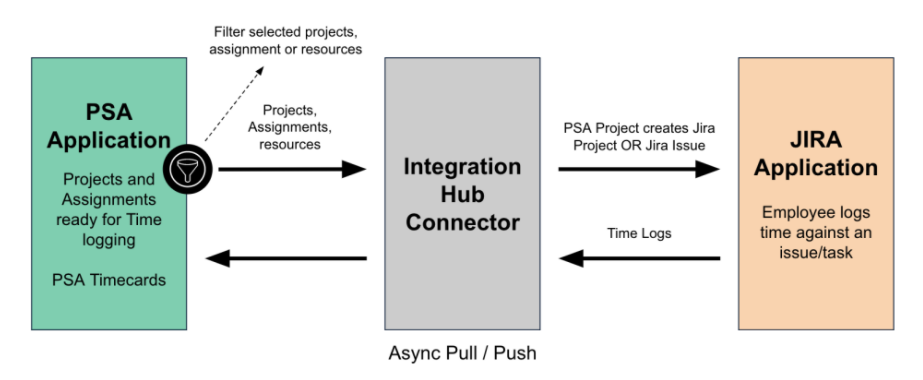

FinancialForce – JIRA Integration

Jira products help teams to manage their work by planning, assigning, tracking, reporting, and managing work. The products and deployment options are purpose-built for Software, IT, Business, Ops teams, and more.

- A comprehensive view of project health

- Resources enter critical data once

- Shorter time to invoice

- Full synchronization between FinancialForce

- PSA and Jira, no re-entry

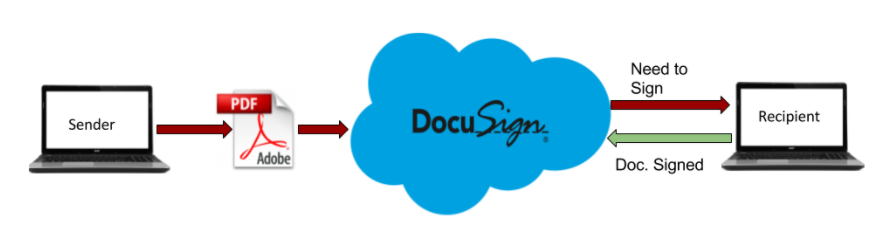

FinancialForce and DocuSign Integration

DocuSign is a product that facilitates the digital signature of the document. Integration of FinancialForce and DocuSign has been adopted by organizations on a large scale to optimize digital processes.

DocuSign is a product that facilitates the digital signature of the document. Integration of FinancialForce and DocuSign has been adopted by organizations on a large scale to optimize digital processes.

- Sign 90% of contracts on the same day

- Directly send data from FinancialForce

- Increase close rates and productivity create a better customer experience

- Track where a document is in the pipeline process

- Removes tedious paperwork and data entry

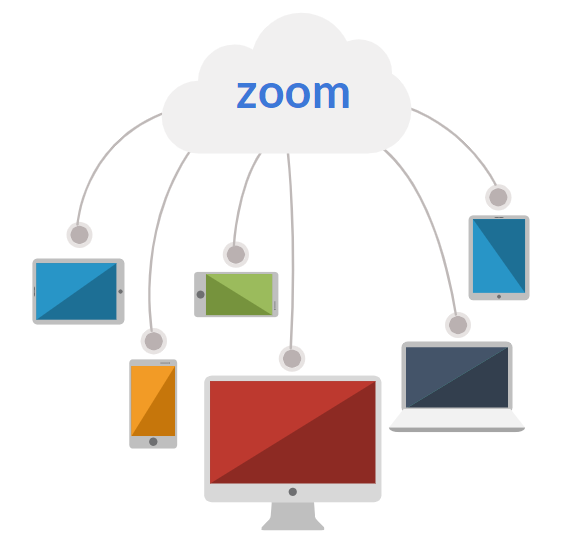

FinancialForce and Zoom Connector Integration

Collaborate efficiently in the pandemic environment with team members around the globe. Zoom Connector integration is available to PSA customers at no extra charge through the FinancialForce Customer Community.

How to Determine If You Should Integrate?

If you’re unsure about integrating API for your enterprise, ask yourself these 5 questions to make the right decision quick:

- Are you wasting a chunk of your time in syncing data between FinancialForce & apps? If yes then it’s high time to try API integration.

- Does your app have an API that connects with FinancialForce? If yes again, then you should know that external APIs integrations are limited to certain APIs.

- Are you equipped with the technical skills to perform a seamless integration?

- Are you seeking analytics beyond the scope of Salesforce & your FinancialForce?

- Do you want to use the same technology for the next 3-5 years & investing in integrations is worthwhile?

Hopefully, it helped you get some clarity on whether you should integrate. If you’re looking for more detailed info, head over to our on-demand webinar video on “APIs and Your FinancialForce: Benefits of an API Integration” featuring our COO, Neeraj Garg, to get a comprehensive guide to API and your FinancialForce integrations.

API Integration Project Pitfalls to Avoid

No matter how careful you are, without proper guidance there always remains a high chance of failure in API integration. Make sure to avoid the common pitfalls mentioned below to put your best foot forward.

- Starting a project with no clear scope

- Custom configurations not taken into account

- Propagation of bad data

- Improper field mapping

- Professional Salesforce Experts not involved

Need an expert to talk about your business and find answers to all your questions? Call us at 240-259-3076 or write to us at wecare@ablypro.com to schedule a meeting.