AI is transforming all spheres of business delivering data insights and fueling smart decision-making. But how exactly does Artificial intelligence augment the financial operations of businesses? AI in Finance help unlock hidden insights, predict trends, and make actionable decisions that enhance financial operations.

CFOs and finance teams face problems with time-consuming manual processes, like data analysis and report generation, which divert attention from strategic decision-making. AI addresses this by automating repetitive tasks, optimizing cash flow, and providing accurate financial forecasts. This frees up time for teams to focus on high-value activities, and make informed, data-driven decisions.

Using AI, businesses can forecast cash flow effectively, manage days to pay and understand trends. This helps in better financial planning helping businesses meet financial targets easily. Leveraging AI in Finance, services businesses can also manage their global customers at scale and respond effectively to their multi-currency, multi-company and multi-language requirements.

In this blog we will dive into use cases showing how AI integration in financial processes can pave way for improved operations and sustained growth.

Level Up Your Finance and Accounting Efficiency with Certinia AI- Three Scenarios to Consider

Certinia AI, built on the Salesforce platform, aims to solve the complexities of the finance team by unifying financial, accounting, and operational data, offering a clear financial picture. AI integration improves financial planning, forecasting, and reporting, helping businesses make smarter, data-driven decisions.

Use cases for AI in Finance

Scenario 1: Optimize Cash Flow

Managing cash flow is necessary for businesses to thrive and optimize financial operations. However, Data silos limit visibility into customer payment behavior, making it difficult to gain insights and resulting in time-consuming cash flow management.

Solution

Certinia’s AI-powered cash flow leverages machine learning and analytics to identify your customers’ payment behavior and predict days to pay. AI dashboards provide visual representation of complex financial data to identify cash inflow/outflow and derive payment trends. With this information, users can predict future cash flow transactions and improve days sales outstanding (DSO).

How this Helps

- Anticipate Cash Flow Gaps and Prevent Delayed Payments.

- Leverage Predictive Insights to Optimize Spending and Investments.

- Spot Inefficiencies and Eliminate Bottlenecks in Payment Processes.

- Create Dynamic Cash Flow Models for Accurate Budgeting and Planning.

Scenario 2: Streamline Financial Forecasting

Evaluating an organization’s financial health using legacy processes can be tedious. Besides, managing multi-currency transactions and reconciliations using multiple platforms can lead to inaccurate forecasts and missed opportunities.

Solution

Certinia’s AI-powered financial forecasting uses predictive analytics and machine learning to analyze historical data, and real-time variables. This multi-currency, multi-company software seamlessly generates accurate, dynamic forecasts that evolve with changing conditions. AI in Finance detects patterns and anomalies to refine forecasts continually, ensuring precision.

How this Helps

- Enhance forecast accuracy with data-driven insights.

- Adapt dynamically to market fluctuations.

- Anticipate cash flow gaps or surpluses.

- Manage multi-currency payment models effortlessly.

Scenario 3: Build AI-powered Financial Reports

Finance teams have data in different systems making it challenging to create comprehensive financial reports. Legacy processes make this task even harder, increasing the risk of errors, overlooked insights, and delays in decision-making, especially with large volumes of data.

Solution

Certinia’s AI-driven reporting turns raw financial data into actionable insights and easy-to-read reports. Finance teams can connect financial and operational data, improve categorization and visualization, and access interactive dashboards highlighting trends and variances. Generative AI uses natural language processing (NLP) to create tailored report summaries that align with business goals.

How this Helps

- Get real-time updates.

- Uncover hidden patterns in financial data.

- Simplify complex data with clear visualizations.

- Automate repetitive tasks to improve operational efficiency.

Elevate Your Financial Processes with Certinia AI

The right Certinia AI implementation can empower financial teams and optimize accounting operations. Imagine managing enterprise accounting on a unified platform—achieving this requires smooth and seamless implementation.

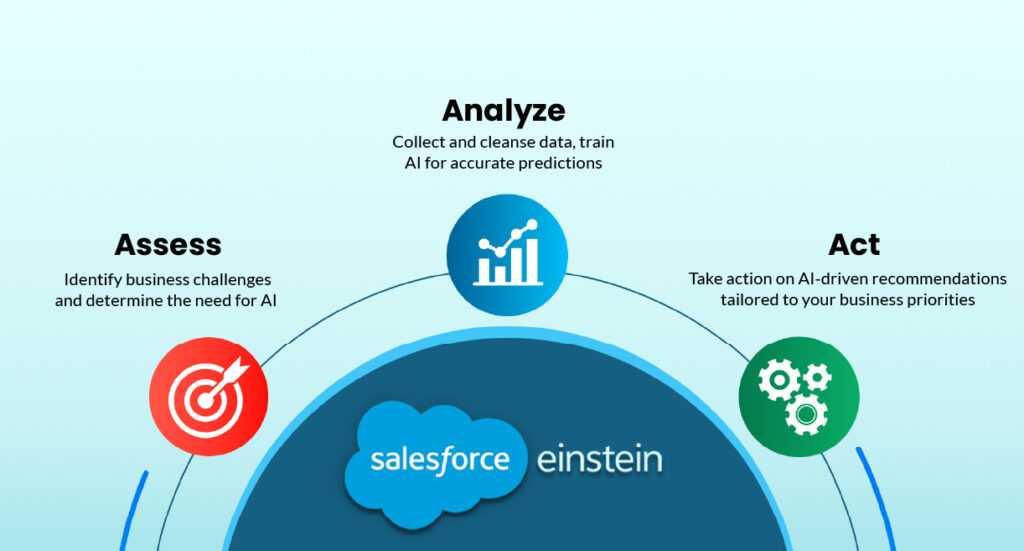

At AblyPro, we specialize in implementing Certinia AI solutions tailored to enterprise needs. Our approach strategically integrates AI by identifying business needs, ensuring data integrity, and providing clear, actionable insights through intuitive dashboards.

Our approach to AI implementation:

To Sum Up

AI in finance has evolved from being a futuristic concept to a transformative solution for enterprise finance and accounting teams. By using Certinia AI, organizations can balance their long and short-term financial goals with the right solutions for improving cash flow, streamlining financial forecasting, and creating AI-powered dashboards. AI in finance delivers predictive analytics, real-time insights, and comprehensive reporting, creating a single source of truth that drives collaboration and enables smarter decision-making.

People may also ask:

- AI for Marketing Department

- AI for Sales Department

- AI for Project Management/Delivery Department

- AI for Customer Service Department

Author

Global COO, AblyPro

For 20 years, Neeraj has worked alongside a multitalented team to help associations and nonprofits drive digital transformation within their organization, enabling them to be more innovative, agile, and donor/member-centric. As AblyPro’s Global COO, he leads an internal task force that shares lessons learned, best practices, and practical applications that specifically relate to associations and nonprofits. With 300+ developers by his side, Neeraj provides clients with the resources and capacity to power up their teams.