In today’s world, where businesses are looking for ways to better utilize staff time and increase productivity while ensuring efficiency, cloud-based accounting software has taken over bookkeeping. Certinia’s (formerly FinancialForce) Accounting tool is a part of its ERP setup – a cloud-based accounting software that can help you manage finances more efficiently. In this blog, we’ll talk about some of the key conceptual overview of Certinia accounting element so that it can help you in your journey towards optimizing business management.

So, let’s begin!

How Accounting is More “Certain” with Certinia?

Accounting can be a time-consuming and complex process, but Certinia offers a comprehensive suite of cloud-based accounting tools that can help streamline your workflow and improve your overall efficiency.

Top 4 Benefits when you Leverage Certinia for Streamlining Accounts:

Seamless Certinia Integration:

- It integrates with a variety of other business applications, including Salesforce and other CRM systems, making it easy to manage all aspects of your business in one central location.

- It offers a suite of integrated accounting and financial management tools that make it easy to manage all aspects of your finances in one place.

- This can save time and reduce errors by eliminating the need for manual data entry and reconciliation across multiple systems.

Automated processes:

- Certinia automates many of the routine accounting tasks, such as invoicing and billing, freeing up your time to focus on more strategic activities.

Real-time insights:

- With Certinia, you have access to real-time financial data and reporting, allowing you to make informed decisions about your business at any time.

- In addition, Certinia includes features like automated billing, invoicing, and revenue recognition.

- Certinia can also help in streamline your accounting processes and improve cash flow management.

Customizable workflows:

- Certinia is built on the Salesforce platform and offers customizable workflows and processes, so you can tailor the system to meet the specific needs of your business.

- It means it can be easily customized and integrated with other business applications.

- This flexibility allows you to tailor the system to meet your specific needs and workflows, making it a powerful tool for managing your accounting and financial operations.

Overall, using Certinia for accounting can help you save time, reduce errors, and gain greater visibility into your financial operations – all while providing a seamless experience for both you and your customers.

Basic Concepts of Certinia Accounting

Now let’s walk over the key concepts around Certinia accounting.

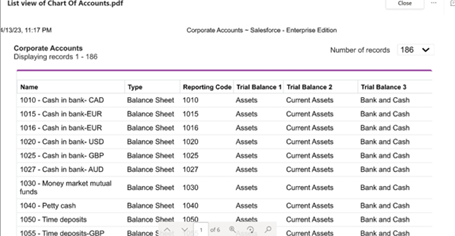

Chart of Accounts

A chart of accounts (COA) is a set of rules that govern the application of standard accounting concepts and practices. The chart of accounts list is the starting point for entry into the accounting system and is critical to producing financial reports. It comprises some major parts: assets, liabilities, revenue, expense, and equity (or capital).

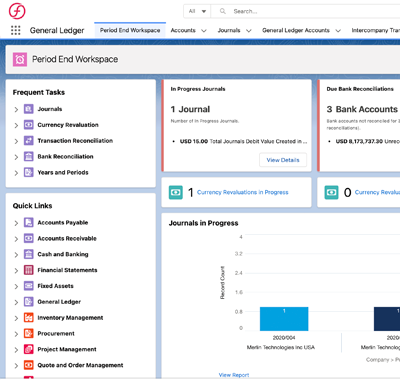

General Ledger

General Ledger is one of the two main types of financial records in accounting. It is a chronological record of transactions for all accounts from the beginning of the year to the end of the year totals. It has a basic purpose – to ensure that all financial transactions are recorded and posted to prepare accurate financial statements.

Primarily, there are three types of General Ledger Accounts in Certinia:

- Balance Sheet (Assets & Liabilities)

- Profit & Loss (Income & Expenses)

- Retained Earnings

Tax Codes and Rates

You must create a separate tax code for each different type of tax you want to record. The tax codes you need to set up will depend on your country’s legislation and how you and your customers are registered for tax purposes.

NOTE: The Tax Rates related list lets you set new tax rates for each tax code.

Detailed Analysis of Custom Input Form Manager in Certinia Accounting

In Certinia Accounting, the Input Form Manager is a tool that allows you to design and customize input forms for data entry in the system. This feature simplifies the process of entering information into the system, making it easier to manage financial data. With Input Form Manager, you can:

- Create custom fields and layouts.

- Set up validation rules.

- Control the visibility of fields based on user roles or permissions.

This level of customization ensures that your team can enter accurate financial data quickly and easily, improving your overall accounting accuracy and efficiency.

Default Custom Input Forms include 6 document types in Certinia Accounting:

- Sales Invoice: Sales Invoice is a default custom input form that allows you to create and send invoices to customers for goods or services sold. It includes fields for customer information, item description, quantity, price, and any applicable taxes or discounts.

- Sales Credit Note: A Sales Credit Note is used to adjust or cancel a previously issued sales invoice. It allows you to issue credit notes to customers for returns or adjustments to previously issued invoices. For example, if a customer returns a product or requests a refund, the business may issue a credit note to reduce the amount owed by the customer. It includes fields for customer information, item description, quantity, price, and tax information.

- Payable Invoice: Payable invoices are documents that businesses receive from their vendors or suppliers, requesting payment for goods or services received. It enables you to create and track invoices from vendors or suppliers. These invoices typically include details such as the vendor’s name and contact information, the date of the invoice, a description of the goods or services provided, quantity, price, and the amount due.

- Payable Credit Note: A payable credit note is a type of financial document that is issued by a supplier or vendor to a customer to request a credit for goods or services that were previously billed. It is essentially a negative invoice that is used when there is an overpayment, incorrect billing, or other issues with an invoice.

- Journal: A journal entry is a record of a financial transaction that shows the debit and credit amounts involved in the transaction. It includes debits and credits for various accounts, such as expenses, revenues, assets, and liabilities. These are also used to adjust account balances and record transactions that do not involve cash, such as depreciation or accrued expenses.

- Cash Entry: A cash entry is a type of journal entry that records a cash transaction, such as a deposit or withdrawal from a bank account. This form allows you to easily track your cash flow and ensure accurate accounting records. It typically includes information such as the date, amount, account name or number, and any relevant notes or descriptions.

Objects in Certinia have a crucial role to play. Check out Certinia Accounting Objects where we have discussed the key terminologies in accounting with respect to Certinia and of course, the importance of Certinia objects.

Get webinar on FinancialForce Accounting: Conceptual Overview for more simplified solution.

Key Takeaways

Certinia Accounting is a powerful tool that can help businesses streamline their financial operations, save time, and reduce errors. By gaining greater visibility into your finances, you can make more informed decisions and improve your overall financial performance.

Whether you’re just starting out or looking to grow your business, Certinia Accounting is a great choice for managing your finances. If you have any questions or want to learn more about how Certinia Accounting can benefit your business, don’t hesitate to consult our team of experts. We’re always here to help.

Author

Project Manager, AblyPro

Manish Maid is a FinancialForce Project Manager at AblyPro with deep technical expertise in handling Enterprise Resource Planning software for optimizing Financial Management, Account Receivables, Account Payables, and other finance functions. With over 25 years of experience in training, implementation, business accounts and operations management, Manish enables organizations to simplify and streamline accounting complexities to optimize business processes while improving operational efficiency and boosting customer satisfaction.